A complete AML solution for Accountants.

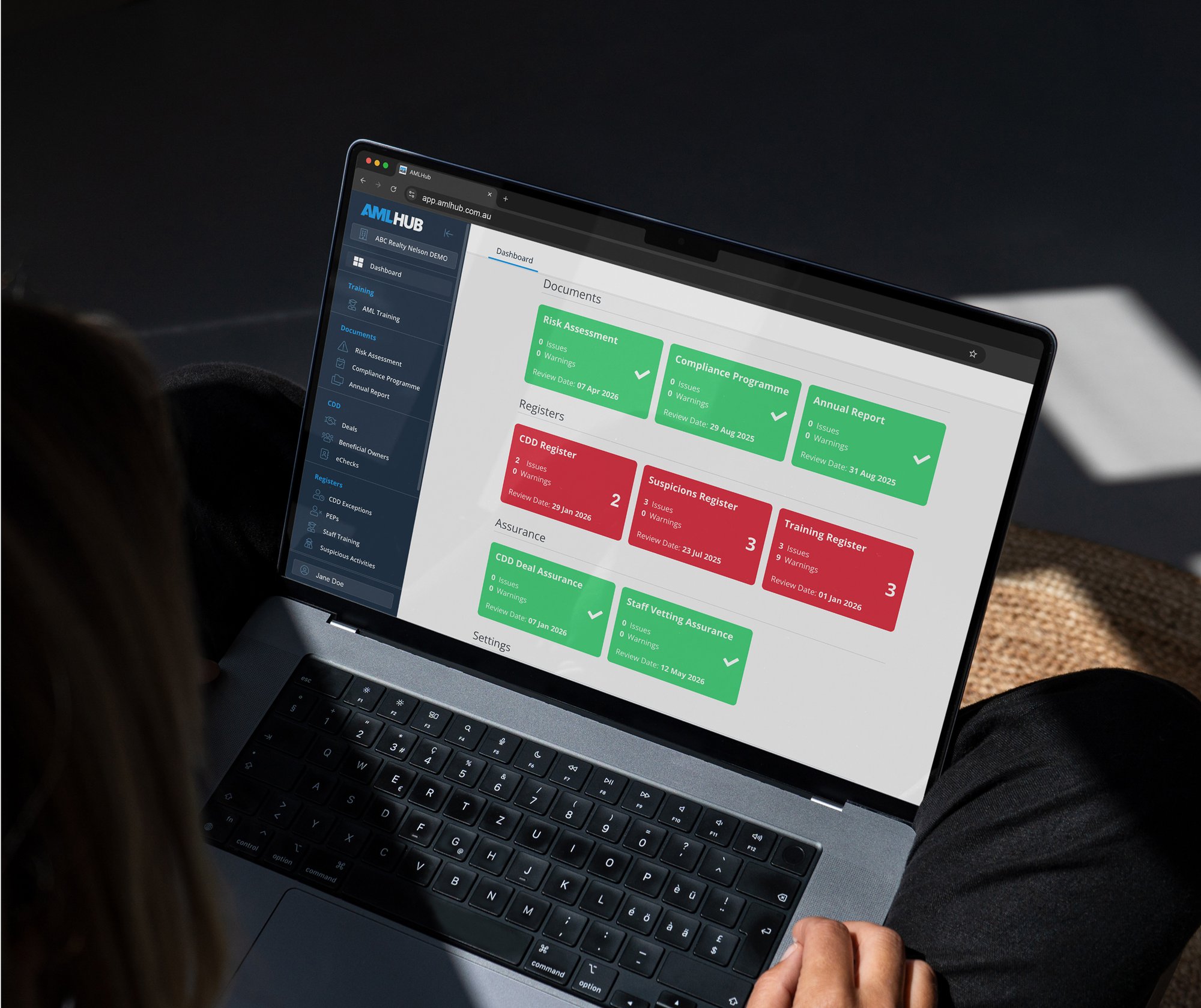

From your first compliance documents to ongoing reporting, AMLHUB brings together everything your practice needs to meet its AML obligations, all in one place.

A complete AML solution for Accountants.

From your first compliance documents to ongoing reporting, AMLHUB brings together everything your practice needs to meet its AML obligations, all in one place.

Why accountants

love the AMLHUB platform.

Relevant

Built to suit a simple AML/CTF workflow.

Relevant

AMLHUB was developed in 2018 for best-practice AML onboarding.

Easy

Easy to learn, easy to use.

Easy

Over 10,000 people use the AMLHUB platform.

Scaleable

Works across roles and business sizes, from sole traders to cross-country firms.

Scaleable

Add as many branches and users as you require.

Centralised

Keeps everything compliant and audit-ready

Centralised

Ensure AML continuity as your business grows and develops.

"AMLHUB has made managing our AML obligations so much easier. The platform is clear, organised, and easy for our team to use day to day. Their CDD outsourcing service saves us hours on client onboarding, and the consulting support gives us confidence that we’re staying fully compliant."

Helen Edwards

AML Compliance Officer

K3 Legal

Your AML/CTF Obligations

While AUSTRAC is still finalising its sector-specific guidance, accountants and tax agents are expected to be brought into the AML/CTF regime in much the same way as other reporting entities.

Develop and maintain an AML/CTF program

Every captured accounting firm will need a documented AML/CTF program tailored to their business.

It should outline policies, procedures, and controls for identifying and managing money laundering and terrorism financing risks. These programs must be regularly reviewed and updated.

Customer Due Diligence (CDD/KYC) checks

Accountants will be required to verify the identity of clients before providing designated services.

This includes collecting information such as names, addresses, beneficial ownership, and source of funds.

Enhanced due diligence will apply for higher-risk clients or transactions.

Ongoing monitoring

Firms must monitor client relationships and transactions on an ongoing basis.

This includes checking for unusual activity, changes in client behaviour, or transactions inconsistent with the client’s profile.

Suspicious Matter Reporting (SMRs)

Any transaction or activity that raises suspicion of money laundering, terrorism financing, or other criminal conduct must be reported to AUSTRAC.

Reports must be submitted within specific timeframes (generally 3 business days for serious matters).

Other reports (e.g. TTRs, IFTIs)

Depending on the services provided, accountants may also need to report certain cash transactions (over $10,000) and international funds transfers.

Staff training

All relevant staff must be trained to understand AML/CTF risks, obligations, and internal procedures.

Training should be ongoing and refreshed regularly, with records of attendance kept.

Independent review

AML/CTF programs will need to be reviewed independently at regular intervals to ensure they are effective and compliant.

Want to see how it works?

Resources

AML/CTF Acronyms Guide

Get to know the jargon by downloading our quick-guide to the most common AML/CTF acronyms. Fill out the form to access.

Want to see

how it works?

Book a walkthrough and

we’ll show you how AMLHUB

fits into your firm's workflow.